city of mobile al sales tax application

The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

Contractors Gross Receipts Tax.

. Box 1750 Foley AL 36536. 2 1206 Sq Ft Call For Price. City of Mobile Business LIcense Overview.

City of Mobile Alcoholic Beverage Application. Select Popular Legal Forms Packages of Any Category. Monday through Friday 8am-5pm.

Ad Have you expanded beyond marketplace selling. All Major Categories Covered. 251 574 - 4800 Phone.

This rate includes any state county city and local sales taxes. City of Montgomery Sales Tax. Police Jurisdiction Lodging Tax.

Prepare and file your sales tax with ease with a solution built just for you. MOBILE Alabama -- After weeks of conjecture Mobile Mayor Sam Jones on Tuesday officially asked the City Council to reintroduce a one-percentage point increase in the sales tax rate to. Ad Instant Download and Complete your Business Forms Start Now.

For any additional information call 251-208-7434. Police Jurisdiction Sales Tax. If you have questions please contact our office at.

Dry Cleaning Registration Fees. City of Calera Revenue Tax Application PDF Tobacco Product Sales Tax Return Form PDF. See information regarding business licenses here.

In mobile or our downtown mobile office at 151 government st. Rental Tax Return- City. Avalara can help your business.

However However pursuant to Section 40-23-7. What is the sales tax rate in Mobile Alabama. The latest sales tax rate for Mobile AL.

Access directory of city county and state tax rates for more taxes. In Mobile Downtown office is open on Monday and Friday only. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000.

The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100. Prepare and file your sales tax with ease with a solution built just for you. The minimum combined 2022 sales tax rate for Mobile Alabama is 10.

Laurel Avenue Foley AL 36535. Seller Use Tax Tax Form 13. 2020 rates included for use while preparing your income tax deduction.

- Exemption of certain covered items from municipal sales and use taxes during the first full weekend in August of each year. This is the total of state county and city sales tax rates. Ad Have you expanded beyond marketplace selling.

Avalara can help your business. Apply for a Mobile. Business License Application.

Sales Tax Application Form. A As used in this section the terms covered items. Hydroelectric Kilowatt Hour Tax.

City of Calera Revenue Tax Application PDF Tobacco Product Sales Tax Return Form PDF. Sales Tax Form 12. Effective March 1 2021 the City of Foley will begin.

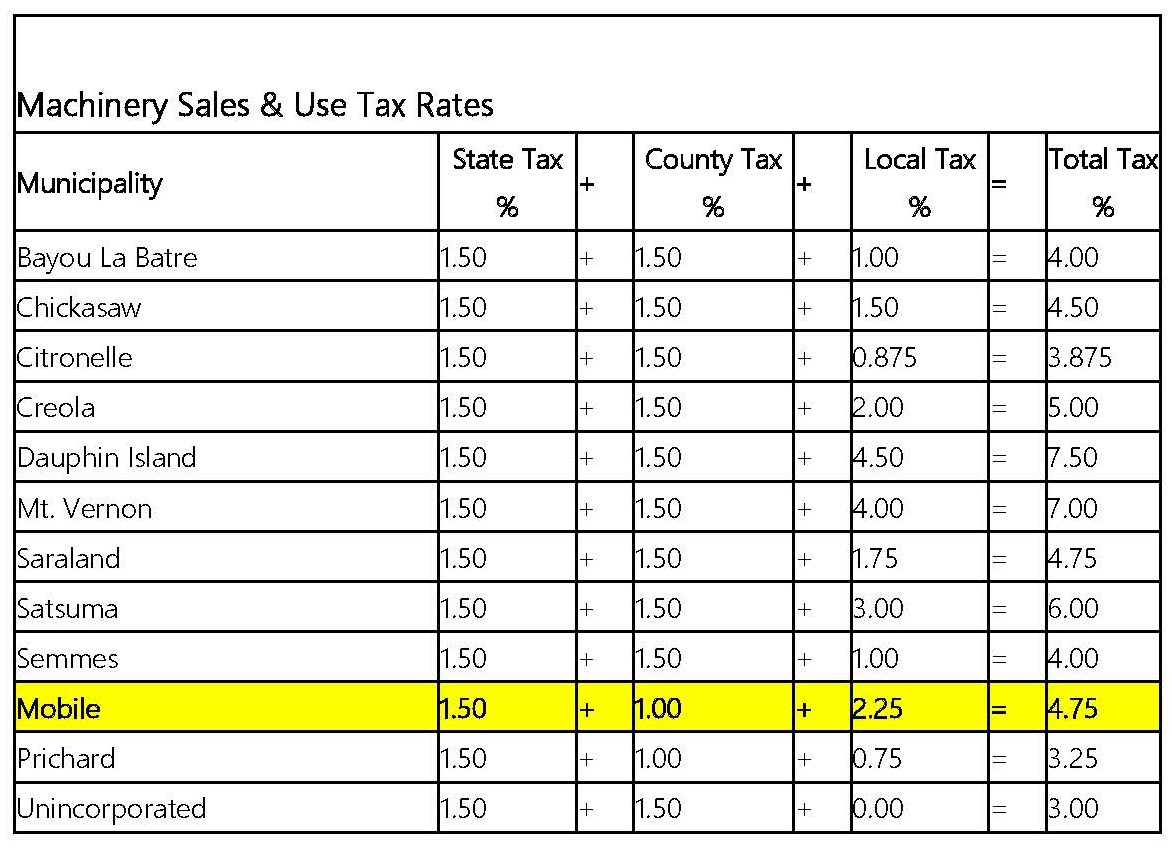

Taxes Mobile Area Chamber Of Commerce

Port Of Mobile Alabama Port Authority

City Of Mobile Business License Renewal Fill Online Printable Fillable Blank Pdffiller

Missouri City Tx Official Website Official Website

Sales Taxes In The United States Wikipedia

Electric Utility City Of Roseville

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Licenses And Taxes City Of Mobile

Sales Use Tax Department Of Taxation

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue